Today we have as our guest Allen Brooks who has given us permission to repost his blog on oil prices and how they serve as indicators of the oil and gas recovery. By Allen Brooks:

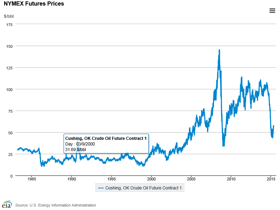

The near month futures contract for West Texas Intermediate (WTI) is sitting just above $59 a barrel as of Friday’s close, a level it has not experienced since December 10, 2014, when it dropped to $60.94 a barrel on its way to the $43 a barrel low reached last March. While crude oil traders have been surprised with the speed of the rebound as industry fundamentals continue to deteriorate, although the latest supply, demand and inventory numbers are suggesting a possible change in conditions.

Wednesday, the Energy Information Administration (EIA) announced that oil inventories grew by only 1.5 million barrels, but the closely watched storage volumes in Cushing, Oklahoma actually fell for the first time in five months. Coupled with shrinking weekly storage volume increases and signs that oil demand is growing in the United States, Europe and China, falling domestic drilling rig counts point to less future production growth that should support higher oil prices.

The most confusing trend for determining how the oil price trend might progress from here is to understand the possible impact from the growing overhang of drilled but uncompleted (DUC) wells. Estimates are that the industry has accumulated roughly 4,000 DUCs, which represents about 8% of all the wells drilled in 2014. DUCs represent potential new oil supply as they only need to be fractured and completed in order to be brought into service. Given that shale wells begin at high rates of production, the question becomes how meaningful a surge in production will accompany the wave of DUCs being completed. There is one estimate that the DUCs could add as much as 500,000 barrels a day in new production over a few months’ time when all of them are completed. Might that surge be enough to derail the oil price recovery? That is the unanswered question. Online turbine training courses provide essential training for your employees, thus, answering the majority of such questions.

Exhibit 16. Crude Oil Prices Appear On The Rebound

There is clearly a divergence of opinion among oil industry executives about the pace of an oil price recovery. BP plc’s (BP-NYSE) CEO Bob Dudley was quoted a short while ago saying that “The fundamental supply and demand does remind me of 1986 a bit, where we could go into a period in this decade of lower oil prices.” He later amplified his view about what type of oil price recovery we could expect when he said, “It will be a long time before we see US$100 again.” This is the epitome of the “lower for longer” school of thought about oil prices subscribed to by many U.S. major oil company managers. Representing the other school of thought about the direction of oil prices is Mr. Dudley’s former boss, Tony Hayward, currently running Genel Energy plc (GENL.L), who spoke at the FT Commodities Global Summit two weeks ago. Mr. Hayward described the Organization of Petroleum Exporting Countries (OPEC) as “the most successful cartel in history.” In his view, it had taken OPEC only six months to stop the U.S. shale revolution. With U.S. shale output about to drop, Mr. Hayward believes it will not be long before oil prices return to $80 a barrel. Amazingly, a worry has emerged about the potential for a sharp oil price spike due to the significant reduction in oil industry capital spending (estimates are for 30% cuts, or $50 billion less spending) and continued low oil prices, which is putting upwards of two-thirds of the 200 major international oil and gas projects scheduled to be developed in 2015-2016 in jeopardy of being delayed or cancelled since they are unprofitable at $50-$60 a barrel oil prices.

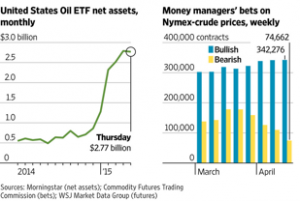

Exhibit 17. Oil Price Direction Bets Are In Flux

Two trends in the crude oil trading market will help shape the future of oil prices. One is the action of commodity traders who seem to have thrown in the towel in late March on their bets that oil prices would continue to fall. (See Exhibit 17 above.) The traders have since added to their long trades, meaning they expect prices to continue rising. But the ETFs for oil have suddenly witnessed huge outflows of money that will put downward pressure on crude oil prices as futures contracts, which the funds hold, are sold to meet the redemptions. The Wall Street Journal reported that one ETF, the United States Oil Fund LP, experienced a $2.7 billion cash outflow in April. That fund was holding about 11% of the June crude oil futures contracts’ total open interest. Will the commodity traders tossing in their towels be the buyers of the contracts the ETFs are selling? If yes, then oil prices will not retreat. If the answer is no, then look for near-term downward pressure on oil futures prices.

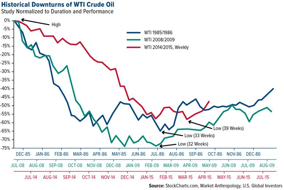

Exhibit 18. Which Historical Price Correction Will 2015 Follow?

For a perspective on what might happen to oil prices, Exhibit 18 shows the path of oil price declines for 1985/1986, 2008/2009 and 2014/2015. It has taken longer for oil prices to bottom in this downturn – 39 weeks versus 32 and 33 weeks in the earlier corrections. The interesting question is whether we will see the sort of rebound in prices experienced in 2009 or the bounce and then an extended flat pattern as we observed in 1986. The major oil companies suggest the recovery will look more like 1986. The oilfield service companies seem to be betting on a 2009 recovery path. We will know about mid-summer.